Blue Ocean Strategy: 7 Steps to Ignite Business Transformation

“Blue Ocean Strategy,” by W. Chan Kim and Renée Mauborgne, is a pioneering blue ocean…

Insight Team

January 1, 2025In the previous chapter, we delved into the world of market research for your retail business, uncovering valuable insights and trends that could shape your venture’s success. As you embark on your entrepreneurial journey, it’s time to lay a solid foundation for your business with a crucial tool: the business plan.

So, what exactly is a business plan? It’s your roadmap, your blueprint, the compass that will guide you through the uncharted waters of business ownership. A well-structured business plan is your recipe for success.

Whether seeking investors, securing a loan, or simply charting your path forward, a well-crafted business plan is your ultimate tool for steering your business toward profitability and growth. In this chapter, we’ll walk you through the process of creating a tailor-made business plan in nine steps for your retail venture.

A business plan is a comprehensive written document that outlines a business’s goals, strategies, and operational details. It serves as a roadmap for entrepreneurs and organizations, providing a clear and structured overview of how the company intends to operate, grow, and achieve its objectives. This document is not only used by small businesses and startups. Even well-established companies use business plans.

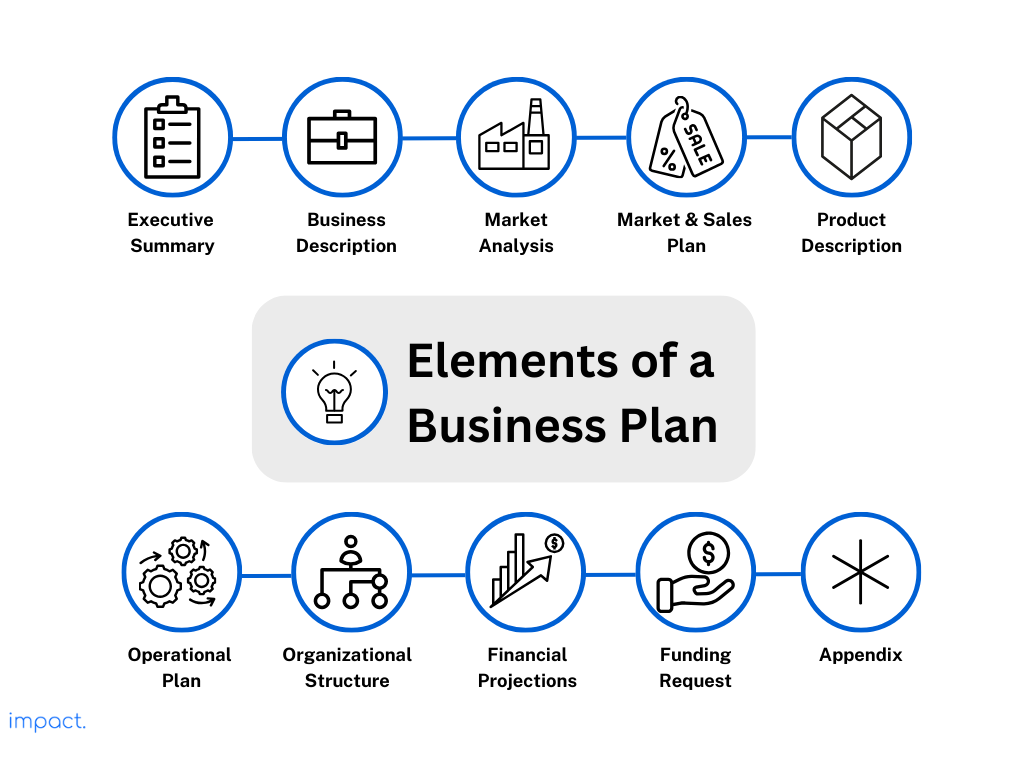

A business plan typically contains these elements:

Business plans can be long, short, straightforward, or complex, depending on what kind of business it is and who will read it. They should be updated as the business changes and grows.

Ensuring a well-organized business plan is in place for your company will help position it for success. Here are nine simple steps to write one, starting with the executive summary.

Start your business plan with a concise executive summary. This section is like the “quick start” button for your project. It gives readers a fast glimpse of your business, its purpose, and the most critical parts of your plan. Think of it like a trailer for an exciting movie — it should grab their attention and give them a taste of what’s coming next.

In the executive summary, focus on the key points. While making your business plan engaging and informative is essential, remember to include detailed information in other sections. This section is your chance to set the stage for the entire document. So, make it attention-grabbing, clear, and actionable. It’s the first thing your readers will see, so make it count.

Begin by painting a clear picture of your company. Provide a thorough description covering essential aspects such as your company’s history, its location, how it’s legally structured (like a sole proprietorship or LLC), and most importantly, the specific problem or need your business is here to solve.

This part is your chance to explain why your company stands out. What makes it unique? Highlight your strengths, expertise, or advantages that position your business for success.

When it comes to your business goals, make them crystal clear. Your goals should be specific so there’s no confusion about what you want to achieve. They should also be measurable, which means you can track your progress.

Ensure they’re attainable, meaning they’re realistic and doable. Keep them relevant to your business’s mission and direction. Lastly, add a time element – make them time-bound so you have a deadline for accomplishing them.

Your business plan should include both short-term and long-term goals. You aim to achieve short-term goals quickly, typically within a year. They include increasing monthly sales or launching a new product. Long-term goals are the more prominent, overarching objectives you’ve worked towards for several years. These could be expanding into new markets or becoming a leader in your industry.

Your products or services are central to your business plan. Let’s focus on a dedicated section to give readers all the vital information they need. Begin by offering a detailed description of what you’re offering. Describe what makes your products or services unique, highlighting their features and the benefits they bring to customers. Clearly show how they solve problems or fulfill the needs of your target audience.

If you have any upcoming products in the pipeline, mention them here. Additionally, if your business holds any intellectual property rights, like patents or trademarks, explain how they contribute to your competitive advantage and profitability.

To begin, conduct extensive research on your market. It involves profoundly understanding your industry, target audience, competition, and current trends. Collecting data and insights to demonstrate your knowledge of the market is crucial, including estimating the market size for your products, determining your business’s position in the market, and identifying your competitors.

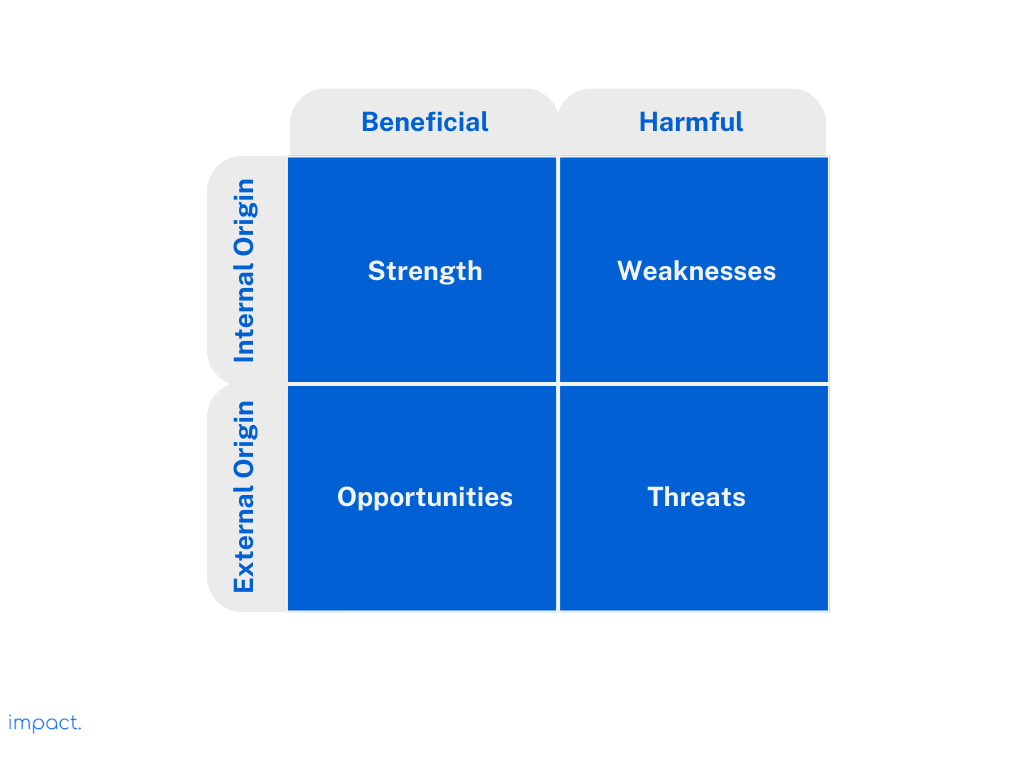

One way of doing this is by conducting a SWOT Analysis. The SWOT analysis is a tool that helps you look at your business’s strengths, weaknesses, opportunities, and threats. You often see it as a grid or a visual chart. It lets your readers quickly see what could affect your business and where you might have an edge over your competition.

Having solid research to back up your conclusions is crucial. It helps convince investors that you know what you’re talking about and lets you double-check your assumptions as you put together your plan. Both lenders and investors will want to know what makes your product different from what’s already out there.

Defining exactly how you’ll sell your products or services in your business plan is crucial. After analyzing your market, you can break down your sales strategy into clear steps.

Start by defining your pricing strategy — how much you’ll charge for what you offer. Next, outline your distribution channels, which are how you’ll get your products or services into customers’ hands. Then, describe your sales tactics, which are the methods and techniques you’ll use to make sales happen. Lastly, talk about your marketing efforts, which include how you’ll create awareness about your business.

Beyond this, clarify your approach to attracting and retaining customers. Outline your strategy for acquiring new customers through advertising, partnerships, or other means. Equally crucial is your plan for maintaining customers, which can boost revenue. Describe how you’ll offer excellent customer service, loyalty programs, or incentives to ensure repeat business.

Now, let’s tackle your operational needs — these are the essential elements that make your business idea a reality.

When it comes to your team, clearly define the roles you must fill. Identify the key positions necessary for the smooth operation of your business. Explain the primary responsibilities of each team member. For instance, you might require sales representatives, customer support staff, or someone to manage your finances.

Consider what your business needs to function effectively. This section includes your physical workspace, whether an office, a storefront, or an online platform. List the equipment required, such as computers, machinery, or specialized tools. Additionally, consider the technology you’ll rely on, including software, websites, or digital systems to enhance operational efficiency.

This section demonstrates your grasp of the supply chain and contingency plans. Whether presenting this plan to others or using it as a guide for yourself, it’s crucial for making important decisions. For instance, it can help determine pricing strategies to cover estimated costs and establish when you anticipate breaking even on your initial investments.

Explaining how your company is structured and who’s in charge of your business plan is essential. It means talking about the people in your management team, their qualifications, and what they do.

Clearly defining the reporting structure and responsibilities within your organization is essential. The explanation will help ensure everyone knows how things operate and who to approach for assistance or inquiries.

The financial section of your business plan is crucial. Regardless of how great your business idea is, its success ultimately hinges on its economic well-being. People want assurance that your business is financially stable for the long run.

In this part of your business plan, you should explain how your business will make enough money to repay loans or provide investors with a satisfactory return. The level of detail required depends on your audience and goals. Still, generally, you should include three main financial views: an income statement, a balance sheet, and a cash flow statement.

It’s also a good idea to include financial data and projections. Accuracy is vital, so thoroughly review your past financial statements before making projections. Your goals should be ambitious yet attainable.

Benjamin Franklin wisely stated, “If you don’t make a plan, you’re setting yourself up to fail.” Franklin’s quote means that success usually doesn’t happen by luck alone but by carefully thinking and organizing your actions.

Some entrepreneurs might think they don’t need a business plan. Still, Franklin’s words remind us that having a plan, setting goals, and thinking about possible challenges can significantly boost your chances of reaching your goals. Even the best business ideas won’t succeed without a well-thought-out strategy to make them a reality.

Here are some reasons why business owners should use a business plan:

A strong business plan is crucial for attracting funding from investors or lenders. Research from Palo Alto Software demonstrates its significance.

They studied 2,877 entrepreneurs, revealing that those with business plans had twice the chance of securing funding. Among the 995 entrepreneurs with business plans, 30% secured loans, 28% secured investment capital, and 50% grew their businesses. In contrast, of the 1,882 entrepreneurs without plans, only 12% secured loans, 12% secured investment capital, and 27% increased their businesses.

The point is this: A good plan isn’t just about explaining your business to investors and showing them your vision. It’s also about proving that you’ve thought deeply about your business, its challenges, and the nuts and bolts of how it will make money. Just talking about your idea isn’t enough; a solid business plan shows your dedication and a clear strategy for success.

Many small businesses don’t make it past five years, but a good business plan can help change that. Think of a business plan as your business’s roadmap. It’s like having a guide that enables you to make wise choices when dealing with decisions or problems.

A business plan is essential for entrepreneurs. It’s not just about money. It’s also about running your business, working with your team, using technology, and keeping your customers happy. When you have a business plan, you can think ahead and solve problems before they become significant. It keeps your business on track with your goals.

Business plans are also helpful when you start working with new partners. A potential partner may want to see your business plan. Partnering takes time and money. A good outline can attract the right partners for your new business.

Bringing in talented people and partners is crucial to make your business successful. A business plan plays a significant role in attracting talent at the right time. People who might work for your company want to know your goals, how you plan to achieve them, and how they can help.

Whether you need experienced leaders or skilled workers, a strong business plan can help you get the best people. It can also keep them motivated and committed to your business for a long time. Within it, you’ll introduce your leadership team and list the jobs you need to fill now and in the future.

Business plans are also helpful when you start working with new partners. A potential partner may want to see your business plan. Partnering takes time and money. A good outline can attract the right partners for your new business.

Business changes quickly. Product features evolve, new competitors show up, and the economy can shift. That’s why a business plan should be flexible. Having a plan makes adapting to market changes, customer needs, and industry trends easier.

To keep your plan flexible, you can include a risk assessment. Many big companies do this, but it’s crucial for new businesses too. You don’t have to cover every single possibility. Instead, show that you can handle changes as they come. Also, have regular check-ins to ensure your business is still going in the direction you originally planned.

A business plan is a unique tool that helps you talk to your team about your business dreams and plans. It ensures everyone in your group understands what you want to achieve and keeps everyone focused on the same goals. This way, everyone works together towards the same targets, making your business more robust and thriving.

Furthermore, your team can rely on the business plan as a guide. It is designed to assist your team in your absence or when they require assistance. Ensure your staff understands that if they ever feel unsure, they can turn to the business plan to figure out what to do next, especially if they can’t reach you for an immediate answer.

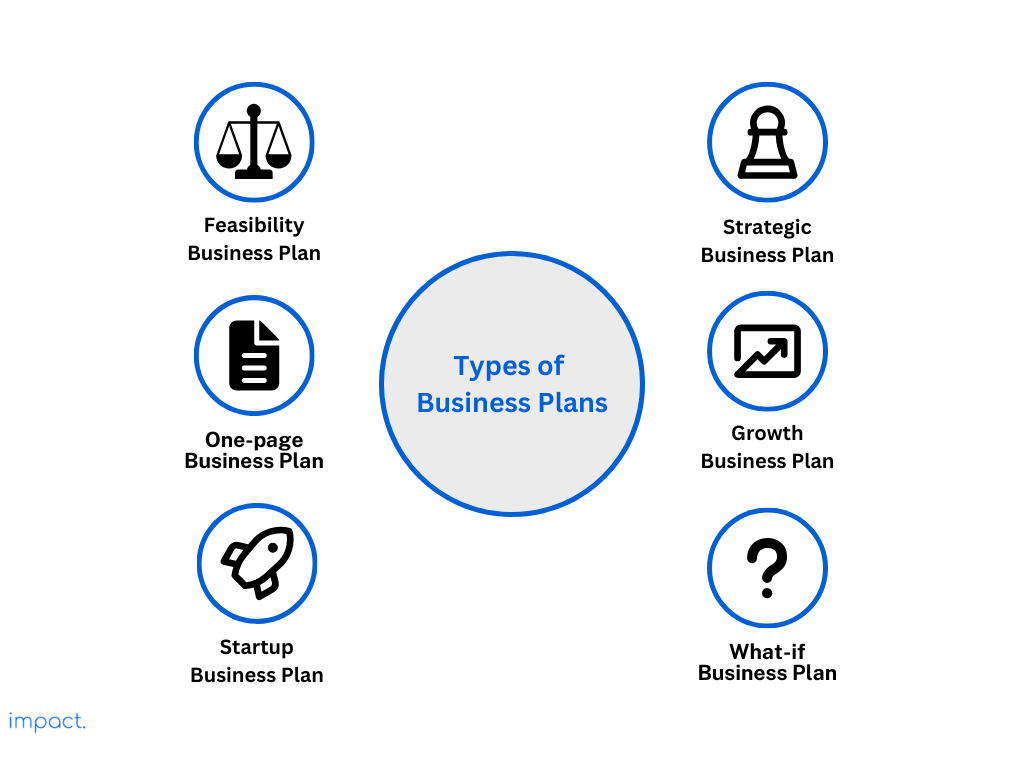

Now that we’ve discussed the importance of having a business plan and its various purposes let’s delve into the diverse types of business plans you can use. These different types cater to specific needs and situations, allowing you to tailor your planning approach to suit your business goals and circumstances. Let’s explore these variations to determine which fits your unique business scenario.

You’ve got your detailed business plan, but sometimes, you need a shorter version to share with key stakeholders. That’s where the one-page business plan comes in. It’s a condensed version of your regular business plan, but it fits on just one page. It’s quick to read and gives the main info about your business idea and strategy.

Think of it as a mix between a business plan and a quick elevator pitch. Even though it’s short, it should still cover all the essential information from your entire business plan.

Here are some specific scenarios where a one-page business plan can be beneficial:

A startup business plan is like a detailed roadmap for your new business idea. It does two main things:

1. Inside Help: It guides you and your team on how to start the business and get results from day one.

2. Outside Help: It shows banks and investors that your business idea is solid.

These plans can be pretty long, and that’s a good thing for investors — they like to see all the details. This type is popular in the tech industry. It focuses on getting a minimum viable product (MVP) first and then growing from there.

Here are the specific needs and situations where a startup business plan is applicable:

Read more: Startup Essentials: Key Definition and 9 Mistakes to Avoid

A strategic business plan is a detailed document that maps out what your organization aims to achieve long-term and how it plans to get there. It acts as your roadmap, guiding your company’s decisions and actions for the next three to five years.

You’ll use this plan to ensure everyone in your organization, including your employees and internal teams, understand your company’s mission, vision, and future objectives. Your strategic plan should balance giving you a broad view of where your business will go and providing enough specifics to help you reach your goals effectively.

Here are the specific needs and situations where this business plan is applicable:

A feasibility business plan is like a decision-making guide. It helps you figure out if your business idea will work or not. These plans are usually used within a company and aim to answer two simple questions: Is there a market for your vision, and can you make money from it?

Unlike startup business plans, feasibility plans are shorter and more to the point. You don’t need to include big-picture ideas about your company. Instead, you concentrate on checking if your idea is doable and profitable.

Here are the specific needs and situations where this business plan is applicable:

A growth business plan, or an expansion plan, is a roadmap for established companies to increase their market presence, revenue, and profitability over a specific period. It outlines the steps to achieve this growth, including the resources needed, such as funding, materials, staff, or additional facilities.

Unlike a startup plan, a growth plan is tailored for existing businesses looking to capitalize on opportunities and enhance their operations. However, similar to a startup plan, a growth business plan should be comprehensive, especially when the readers may not be familiar with your company.

Here are the specific needs and situations where this business plan is applicable:

A “What-If” business plan is a tool for preparing your business for unexpected situations. Instead of sticking to a single strategy, it looks at different “what-if” scenarios and how your business would handle them.

For example, if you run a restaurant, you can create a plan to see how your business would deal with a public health emergency like the COVID-19 pandemic. The plan helps you come up with strategies to minimize the impact.

You can use this plan within your team to get everyone ready and share it with banks and partners to show them that your business is ready for tough times. It’s a way to be better prepared and more resilient.

Here are the specific needs and situations where this business plan is applicable:

Read more: Business Model Canvas: 9 Components to Map Startup Success

Creating a solid business plan is essential to your entrepreneurial journey, whether launching a new retail venture or aiming to take your existing business to the next level. Your business plan acts as your guiding compass, helping you navigate the complexities of the business world with clarity and purpose.

From defining your company’s goals and market analysis to detailing your financial projections, each step contributes to your enterprise’s overall success and sustainability.

The next chapter will explore another critical aspect of setting up your store location. Choosing the right site can significantly impact your retail business’s visibility, foot traffic, and overall success.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

75% of digital transformation projects fail. Take the right first step by choosing a reliable long-term partner.