Blue Ocean Strategy: 7 Steps to Ignite Business Transformation

“Blue Ocean Strategy,” by W. Chan Kim and Renée Mauborgne, is a pioneering blue ocean…

Insight Team

January 1, 2025Managing finances is a crucial aspect of operations for any business. The process of invoicing is essential to financial management.

An invoice records transaction details between seller and buyer. It details the products or services, prices, and payment terms.

Invoices are vital for financial records, sales tracking, and timely payments. Poor invoicing can lead to cash flow issues for many businesses.

Read further to learn more about this commercial document. This article will explain why you need invoices in your business and provide different invoice examples.

An invoice is a document that records a transaction between a buyer and seller. Simply put, it shows what goods and services were purchased and how much they cost.

Invoices are more than just a list of items sold. They are crucial for a small business’s accounting systems. It may also show any taxes or discounts, payment terms, and the total amount due with the payment due date.

Invoices serve various business purposes (which you will learn further in the article). It aids companies in prompting client payments, forecasting sales, tracking inventory, and documenting taxes.

Different invoices may include paper receipts, bills of sale, debit notes, sales invoices, or online electronic records.

However, many people like to interchange invoices with other transaction records. Here are some comparisons that we have compiled for you.

Earlier, we mentioned that invoices are transaction documents that itemize sales calculations. They are different from receipts.

A receipt is written proof that something transfers from one person to another. The item usually has a price value. Various transactions, such as B2B and stock market trades, commonly involve receipts.

The table below compares invoice and receipt differences.

| Feature | Invoice | Receipt |

| Definition | A document requesting payment for goods or services | A document providing proof of payment for goods or services |

| Purpose | Requests payment from customer | Proves payment made by customer |

| Content | Details of goods or services provided, cost, and payment terms | Details of items purchased, cost, and payment method |

| Time of issue | Before payment is made | After payment is made |

| Use case | Used to request payment and track transactions | Used for record keeping and reimbursement |

You may stumble upon the word faktur. This word may translate to “invoice” when you translate Indonesian to English. However, both still have different meanings.

We usually use the term faktur to refer to invoices legally requiring taxable transactions.

A faktur must include specific legal requirements such as the buyer and seller’s name and address, the description of goods or services, quantities, prices, and taxes. Both supplier/vendor and purchaser may be issued a faktur.

The table below compares an invoice and a faktur.

| Feature | Invoice | Faktur |

| Definition | A document requesting payment for goods or services | An invoice required by law for taxable transactions |

| Legal requirement | Not required by law in many countries | Legally required in some countries for taxable transactions |

| Content | Details of goods or services provided, cost, and payment terms | Name and address of the buyer and seller, description of goods or services, quantities, prices, and applicable taxes |

| Time of issue | Before or after goods or services are provided | Before or after taxable transactions |

| Use case | Used to request payment and track transactions | Used to comply with legal requirements and for tax purposes |

Before further explaining an invoice’s function and elements, we must understand its history. Invoices are hardly a new invention. Its origins hail from marking notches on bones to keep track of transactions.

Invoicing has come a long way from its primitive forms. As technology progressed, it has become increasingly mechanized and digitized — eliminating the need for physical paper documents.

Here are some methods that show how far invoicing has progressed.

An invoice serves as a crucial document for businesses. The paper is a binding agreement that confirms both parties’ agreement to the quoted price and payment terms.

In addition to serving as an agreement, invoices have other functions that businesses utilize. Below are some of these functions.

Note management refers to organizing and tracking critical information within a business. Regarding invoices, it relates to recording all business transactions.

Invoices provide businesses with a clear record of expenses for a transaction. This record can help companies manage their notes internally, tracking sales and revenue.

Invoices serve as a tool that aids businesses in managing payments effectively. An invoice clearly shows customers what they owe and when to pay.

As a result, customers make timely payments. It reduces misunderstandings and disputes between seller and buyer.

Invoices provide businesses with the ability to track payments received and outstanding. This tracking makes it easier for companies to manage their cash flow and monitor their finances.

A valid invoice is legal evidence of a mutual agreement between the buyer and seller on a specific price. In a dispute, an invoice can help businesses prove that they fulfilled their obligations and delivered the agreed-upon products or services.

To accurately calculate the taxes owed when filing their taxes, businesses must report their income and expenses. Organized records of invoices and finances can help companies to comply with tax laws, avoiding penalties and fines for inaccurate reporting.

Invoices clearly summarize the products or services sold, their price, and payment terms. You can calculate the income generated from sales and revenue and any expenses incurred to produce those sales.

In addition, businesses can use invoices as valuable data sources for analysis. By analyzing invoice data, companies can identify areas for improvement, develop growth strategies, and make informed decisions about their operations.

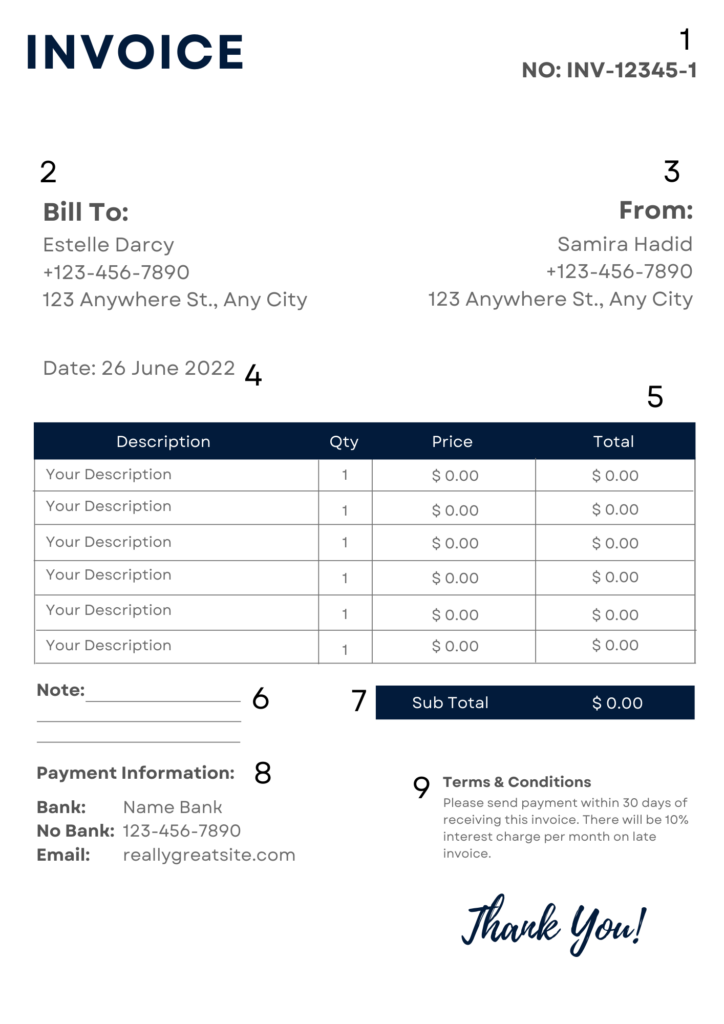

The specific elements that make up an invoice may vary depending on the business type and the transaction’s nature. An invoice typically contains these seven elements, as shown in the invoice sample below.

Industry, billing method, and payment frequency determine the type of invoice a business chooses. Here are 11 different types of invoices that you can create for clients:

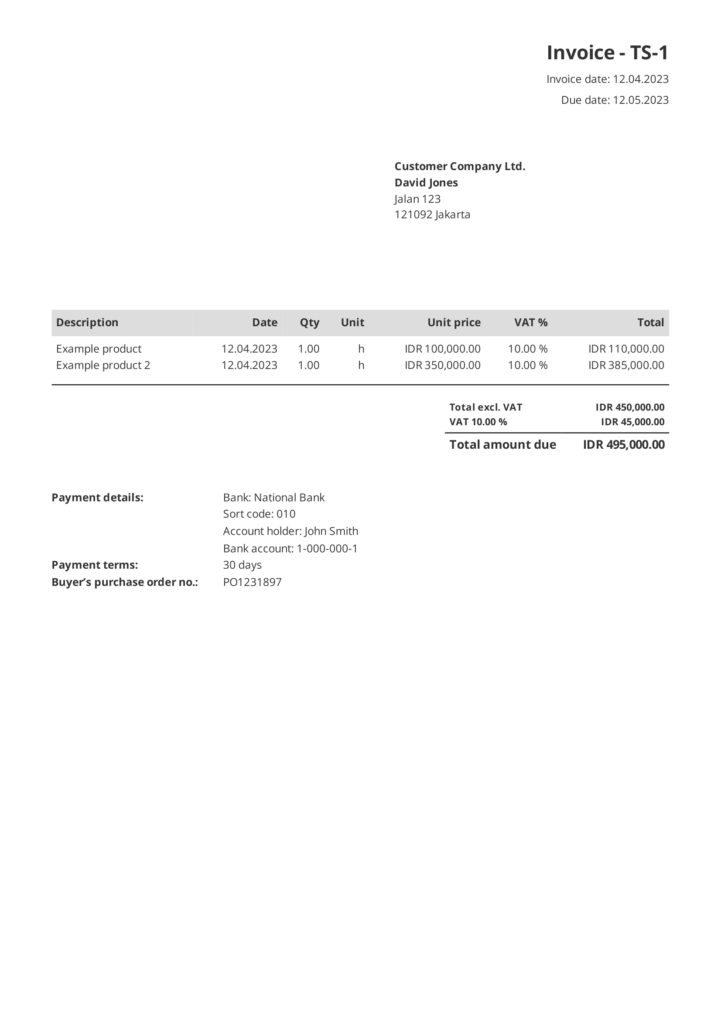

Standard, sometimes called regular invoice, is the most commonly used by businesses. You can use this invoice for most transactions, as the format can fit most industries. This invoice usually contains item details, quantity purchased, price per item, and total price.

You use commercial invoices when dealing with customs, such as shipping internationally. The invoice contains the necessary sales information to calculate customs tariffs for international sales.

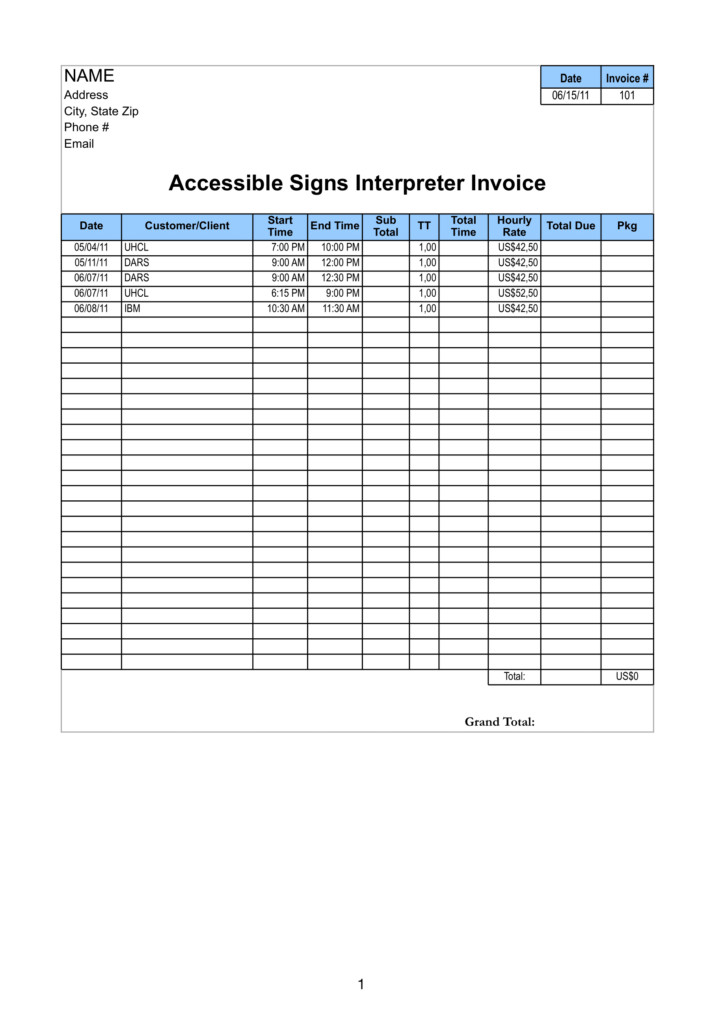

Like its name, this invoice depends on a timesheet. It bills customers for hourly service. It includes the hours worked, the hourly rate, and the total amount due. Industries that use this invoice include lawyers, creative agencies, and psychologists.

Recurring invoices are similar to standard ones but are automatically generated and sent regularly. IT companies often use recurring invoices to charge their clients a fixed amount every month for a bundled IT service.

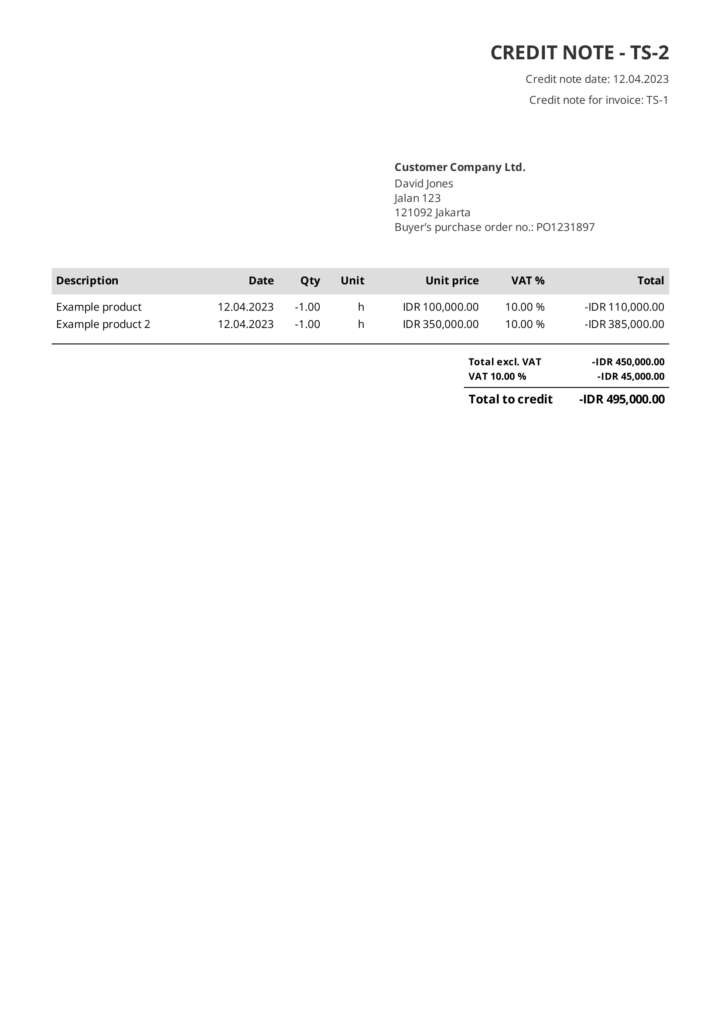

A credit invoice or credit note is issued when a customer has overpaid or if there is a mistake on the original invoice. A credit invoice displays a negative amount, indicating that the customer’s account has been credited.

This type of invoice is the opposite of a credit invoice. It is issued if the buyer has underpaid or has an additional charge for goods or services. This invoice contains a positive amount added to the customer’s account.

Mixed invoices include both credit and debit charges in a single invoice, with the total amount possibly being positive or negative. Small businesses may not commonly use this type of invoice for their services. In certain situations, mixed invoices may be necessary when reducing the amount owed by a client for one project while increasing it for another.

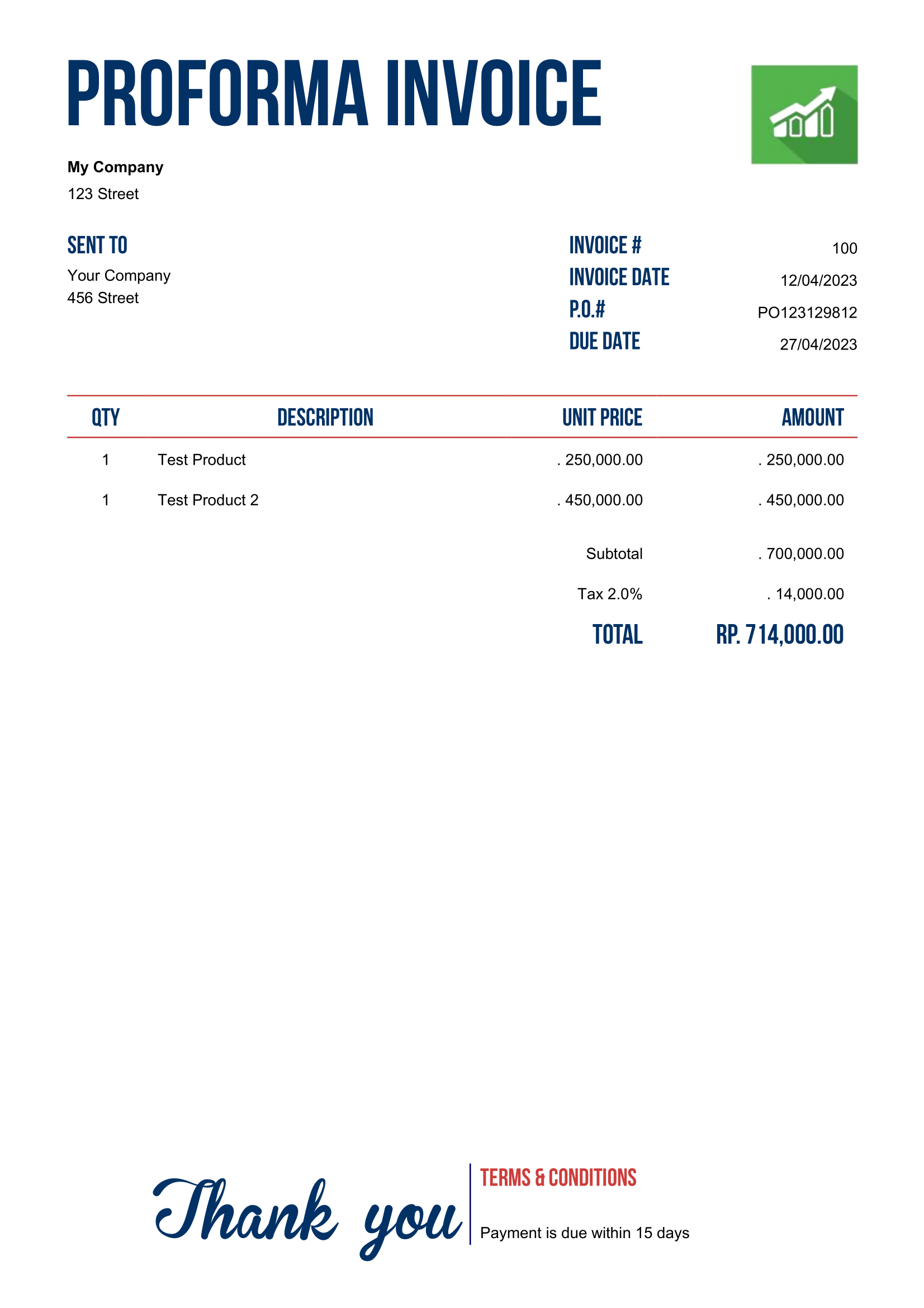

A pro forma invoice is a preliminary invoice sent to a customer before issuing the final invoice. The unique thing about this invoice is that it does not request payment from customers. It gives customers an estimate of the price, which will adjust once the product or service is delivered.

Businesses use this type of invoice to facilitate partial payments during a project or contract, particularly for large projects with extended timelines. It may be based on specific milestones or time intervals and typically includes details of the work completed and corresponding payment amounts.

A past due invoice is an unpaid invoice that has exceeded the payment deadline or has not been paid within the agreed-upon payment terms. It represents an overdue payment that may require follow-up actions for collection, such as reminders or late fees.

The final invoice serves as the culmination of a transaction, indicating that all products/services have been delivered and paid for by the client. It summarizes the total amount due after accounting for previous invoices, payments, and adjustments, representing the concluding step in the business transaction.

Every business wants its customers to make timely payments. We have listed some tips that you can use to ensure punctual invoice payments.

Offering discounts or other incentives for on-time or early invoice payments can motivate customers to pay promptly. You can communicate these incentives in your invoices and give them as promised.

Give your customers multiple payment options, such as credit cards, bank transfers, and online payment portals. These choices provide your customers with convenience, leading to fewer payment delays. Remember always to indicate the available payment methods on your invoices.

Keep track of your invoices and follow up on overdue payments promptly. Send reminders and escalate the matter if necessary. Establish a consistent process for following up on late payments to ensure timely resolution.

Maintaining a positive relationship with your customers can encourage timely invoice payment. Regular communication, excellent service, and prompt payment resolution build customer trust.

Read more: What is SRM? Definition, Benefits & 3 Implementation Steps

Consider using recurring invoices for ongoing services or subscriptions, where invoices are automatically generated and sent regularly. This method streamlines the invoicing process and ensures consistent invoice deliveries.

Utilize invoicing software or other automation tools to streamline the invoicing process, which reduces human error. Automation can also help with payment tracking, reminders, and reporting, improving the efficiency of your invoicing process.

One of the software available in the market is Impact. Invoicing is made easy with Impact’s invoice module. Impact automates your invoicing so you no longer have to input your transactions manually. With Impact, you minimize human errors usually made in finance and ensure you comply with local tax laws and regulations.

Businesses of all sizes must understand the significance of invoices and utilize them effectively. Invoices are vital for financial management, facilitating record-keeping, sales tracking, and timely payments for a healthy cash flow.

In today’s competitive landscape, effective utilization of invoices is crucial for businesses to thrive and succeed. Companies can improve invoicing and financial stability by incentivizing early payments, offering diverse invoice payment options, and building closer client relationships.

Also read: Top 9 Invoice Software Recommendations and Pricing Analysis

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

75% of digital transformation projects fail. Take the right first step by choosing a reliable long-term partner.